DAVID KEAN & ASSOCIATES |

|

Fox NewsCoronavirus, homeless crisis, tax issues have some wealthy Los Angelenos wanting out: "Celebrities are running away" Luxury real estate brokers in Los Angeles say clients want more space, distance away from crowded city To read the article on the Foxnews.com website, click here. |

Source: FoxNews.com, by Julius Young, September 3, 2020

David Kean photo by Tibrina Hobson/Getty Images

https://www.foxnews.com/entertainment/coronavirus-taxes-homeless-los-angeles-celebrities

Source: The Sun, by James Beal, October 3, 2020 (updated October 4, 2020)

|

Real Estate Advice for Home SellersRead Trulia's article "7 Things Your Real Estate Agent Wants You to Know (But Will Never Tell You) by Laura Agadoni, which quoted David's advice for home sellers. Link to the article here, or view as PDF. |

|

Real Estate Advice for Home SellersRead Trulia's article "8 Ways to Motivate Sellers Without Spending More", which quoted David's advice on submitting offers. Link to the article here, or view as PDF. |

|

Penthouse Living - Los Angeles Confidential MagazineWhy are penthouses gaining popularity in Los Angeles? In the past few years, more and more luxury homes have been built in the skies of LA. Download this article published in Los Angeles Confidential Magazine quoting David on why high-rise living is becoming more desirable. To read the article on the Los Angeles Confidential website, click here. |

|

Source: Los Angeles Confidential magazine, "Top of the Town: In Famously Horizontal L.A., Penthouse Living Is Reaching a Peak", by Kathry A. McDonald, September 2014

http://la-confidential-magazine.com/living/articles/penthouse-living-gains-popularity-in-los-angeles

|

Real Estate Advice for Home SellersInvestopedia recently quoted David for his perspective on hiring a real estate agent to sell your home. Link to the article here, or view as PDF. |

Read the complete Market Leader "How to Sell a Luxury Listing" article here.

|

Real Estate Advice for Home Buyers"4 Myths About Making Low Offers That Could Hurt You" features David's advice on submitting offers. Link to the article here, or view as PDF. |

|

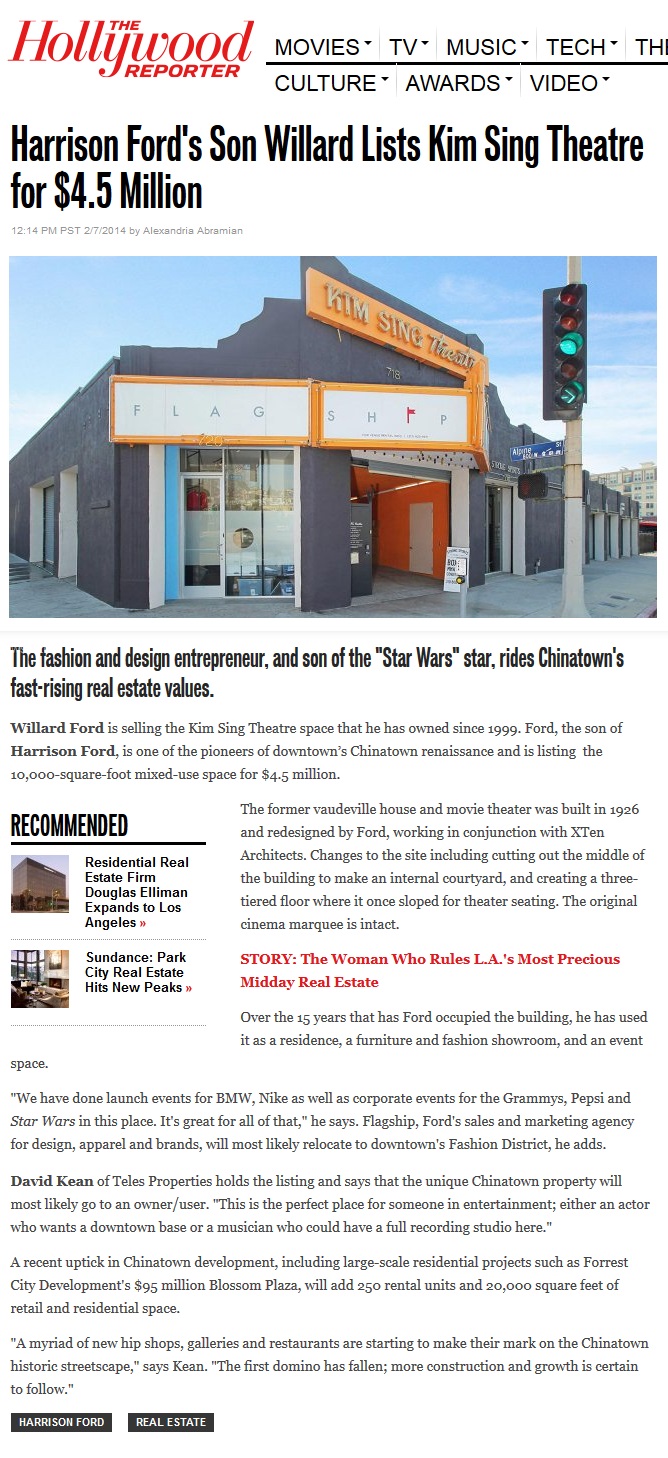

Source: The Hollywood Reporter, February 2014 http://www.hollywoodreporter.com/news/harrison-fords-son-willard-lists-678343 |

|

Source: Variety, April 2014 https://variety.com/2014/scene/news/kim-sing-theatre-hits-the-market-for-4-5-million-1201154471/ |

|

Sunset Strip/Hollywood Hills/Doheny Real EstateRead David's perspective on the Bird Streets real estate market as quoted in Angeleno Magazine. His "selling points" are key to why nesting in the Birds has become so desirable. |

|

Sunset Strip/Hollywood Hills/Doheny Real EstateRead the Los Angeles Business Journal's coverage of David's listing in the West Hollywood Hills/Sunset Strip area. |

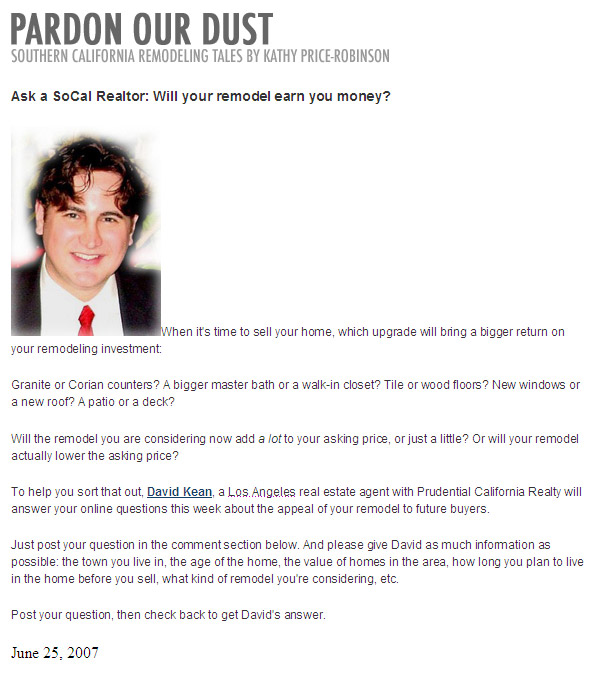

Downtown LA Real Estate UpdateRead the Los Angeles Downtown News article with David's perspective on the current state of the downtown Los Angeles real estate market. |

|

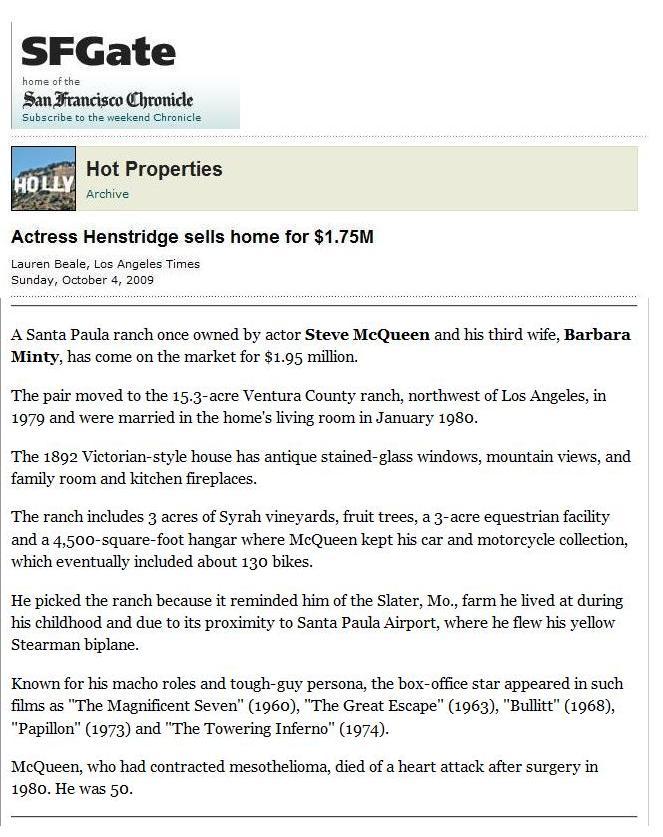

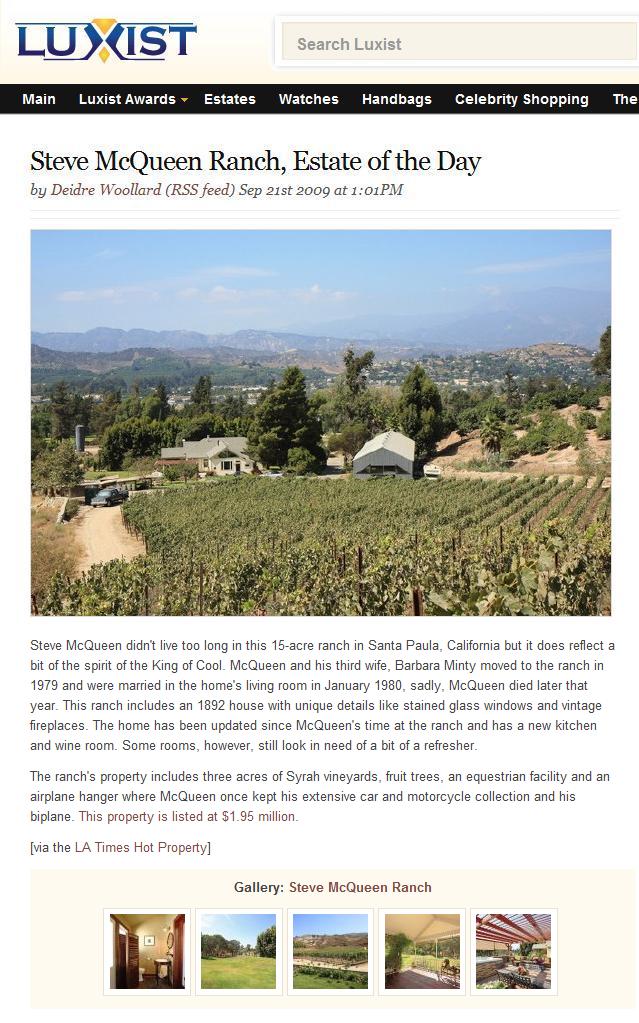

Read Fox News's post on David's listing of the Santa Paula ranch formerly owned by film star Steve McQueen. For the full article, click here. |

Real Estate Advice for Home SellersHave you listed your home for sale and wonder why it hasn't sold? Watch David's advice to homesellers regarding the Top 5 reasons why a home doesn't sell. |

Download the full Bloomberg "Strategies for the Spring Housing Scrum" article here.

Click here to read it on the Bloomberg website.

Source: Bloomberg.com, "Strategies for the Spring Housing Scrum", by Carla Fried, February 2013

http://www.bloomberg.com/news/2013-02-28/winning-strategies-for-the-spring-housing-scrum.html

Source: HGTV Frontdoor.com, January 2012: http://www.frontdoor.com/sell/7-curb-appeal-mistakes-to-avoid/pictures/pg276

Behind the scenes at a luxury home open house

Mar 30, 2012

Aaron Crowe HSH.com

Cocktails with Kobe Bryant, outdoor buffets on terraces bigger than most homes, upscale gift bags, world-famous art, and an 8-foot bar made of ice are just some of the extravagant things you might encounter at a luxury home open house these days. It's enough to make your head spin, if not your wallet. Back when the housing market was thriving, real estate agents could sell almost any home by simply putting a "For Sale" sign in the front yard, rearranging some of the furniture and having cookies baking in the oven during an open house. However, open houses are a lot different nowadays, especially for the rich, who not only want to tour the house, but also want to get a sense of how the home will look and feel when they're entertaining guests. "When you have a unique space, many people who come in do not have the vision of 'what can I do with this space?'" says Thomas Guss, president of New York Residence, the sales and marketing agency at The Centurion, a condominium complex in Manhattan where units sell for up to $39 million. To showcase the double-high ceilings on a $6.5 million apartment, Guss turned it into an art gallery with artwork that had been shown at the Royal Academy of Arts in London. For the 1,500-square-foot apartment -- which had an outdoor terrace larger than the indoors -- Guss had an open house with an ice bar, heat lamps, hot chocolate and cocktails to highlight the terrace and to "paint a picture" of how the home could be used for entertaining. "You have to show people what you can use the terrace for," he says. A $3.5 million offer was made after the event, but the seller is trying to get the $3.8 million asking price, Guss says. Home sales and celebrity star power In April, Cap Equity Realty in Los Angeles is hosting a private party and home tour for investors from China at a Hollywood Hills home where they'll get to meet Los Angeles Lakers star Kobe Bryant. The party will include an outdoor buffet on a terrace overlooking the Hollywood Hills, complete with sponsors who are giving away upscale gift bags, says Jason Jones, vice president of operations for the real estate company. At an upcoming open house for a home in Moorpark, Calif., Jones plans on highlighting the home's 5 acres of 500 avocado trees with a chef making avocado-inspired dishes. The home listed for $1.6 million in September 2011 but is now selling for $1.5 million. Because the site is a little remote, Jones expects about 50 attendees. Without the big event -- which will include a raffle for car detailing and other prizes -- Jones says he'd expect maybe only a dozen people to show up. "It's best to do that at your initial launch," Jones says of making a big splash with a big party and prizes. "You're going to get the most bang for your buck after the initial listing." Another Hollywood Hills real estate agent, David Kean, says that he went nostalgic in one upscale neighborhood to attract buyers. Kean filled an ice chest with soda brands from the 1950s and says it was a hit with both kids and parents who hadn't tasted the sodas in decades. The biggest prizes are for brokers New York real estate agent Edward Longley, founder of The Hollingsworth Group, is offering attendees at one open house the chance to win an iPod, iPhone or carriage ride through Central Park. However, the bigger prizes are reserved for the brokers who bring in successful buyers. Longley says he hasn't yet given a convertible BMW to a broker of a client who buys a $12 million home from him, but he's planning on doing so. (Gifts to brokers are only given after a sale is complete, he says.) Of course, all this might not be needed if the economy were better, although thinking outside of the box is always welcomed in selling luxury real estate, says Jones. "You have to go out and find your buyer," he says. "You can't just hang a sign anymore." |

Source: HSN.com article "Behind the Scenes at a Luxury Open House" by Aaron Crowe, March 2012

|

|

Source: C-Suite Quarterly Magazine, November 2010 |

State of the City

By David Kean

In less than 11 years, Downtown Los Angeles has gone from desolate and dreary to hip, hot, and happening. Years ago, at five p.m., sidewalks would basically roll up and the area shut down. Now, a mixture of residents walking their dogs, convention guests, and patrons sampling chic new restaurants or nightclubs can be seen at all hours. The transformation seemingly took place overnight, but years of planning have made Downtown LA one of the region's most talked-about spots. Since 1999, over $15 billion in private sector investment has poured into the area, helping to create a vibrant and diverse community appealing to both businesses and residents. The primary catalyst for the resurgence of residential development was the city's implementation of the Adaptive Reuse Ordinance. The ordinance offered developers tax incentives, expedited permit approval processes, and adjusted zoning and code requirements. This made it possible to convert historic and economically obsolete buildings into residential, mixed-use projects, many of them loft-style condominium complexes with added amenities like pools, spas, gyms, and screening rooms. At the same time, commercial development was spurred by the opening of AEG's Staples Center, which drew national attention to downtown by hosting the Lakers, Kings, and major entertainment events. Concurrently, luxury apartment communities were built by G.H. Palmer, the first developer in decades to offer upscale living in downtown. The boom culminated in 2007 with the opening of the area's first supermarket in 57 years and LA Live in 2008, with its multiple concert venues, movie theaters, restaurants, nightclubs, and hotels, including the Marriott and Ritz-Carlton. With the plethora of new entertainment possibilities within proximity of the Convention Center, LA was able to compete for national conventions. The economic downturn negatively impacted development, but by then, a critical mass had been established. Downtown residents numbered approximately 43,000, compared to 18,700 in 1999. The false start that happened in the late 1980s was thus avoided. As a result of overzealous, late-to-the-game condo investors and residential projects that had the misfortune of opening after the real estate bubble popped, a favorable buying environment now exists. Current residential buyers include investors (foreign and domestic), as well as empty-nesters, first-time homeowners, second-home buyers, and parents buying lofts for their children in lieu of student housing. All are looking for remarkable deals, and there are plenty of bargains to be had. Despite being a major business hub, Downtown actually has a small-town feel. Several residential developments have wine and book clubs, yoga groups, and weekend pub crawls. It's not uncommon to strike up a conversation with a stranger at the supermarket or dry cleaners. Downtown consists of 15 tight-knit micro-communities. Each neighborhood has its own distinct flavor and demographic. Three of the largest residential hubs are South Park, The Historic Core, and The Arts District. South Park, home to the Staples Center and easily accessible to USC, is the most developed section, featuring mostly newly built, loft-style, high-rise developments, with a handful of buildings converted into lofts. The Historic Core, with its art galleries and boutiques, is the most like San Francisco and New York in architecture and energy. The majority of living options are converted historic buildings. The Arts District was created by artists for artists, and offers larger, raw spaces in converted industrial buildings and warehouses. In general, prices have dropped from a high of $576 per square foot in 2006 to approximately $357. Recent sales activity (according the Multiple Listing Service) shows lofts selling from $85,000 to $2,150,000 for a penthouse. The median price is $330,000. One bedroom unit sales are surpassing two bedrooms by a 6 to 1 ratio. The expansion of the residential and hospitality sectors have created a foundation for the growth of the retail market. An area to watch is the 7th Street corridor. Once the hub of Los Angeles shopping, 7th Street is located within walking distance of thousands of hotel rooms, mass transit, and the heart of the financial district. Hal Bastian, Senior Vice President and Director of Economic Development of the Downtown Center Business Improvement District, is spearheading the 7th Street Retail Recruitment Initiative and has been directly involved with the opening of dozens of new downtown businesses. The initiative is a five-year plan to bring independent retailers to 7th Street. According to Mr. Bastian, the goal is "to create a unique retail environment that is different than any other place in Southern California." Select soft goods retailers are being recruited from the Abbot Kinney, Melrose Avenue, and Ventura Boulevard shopping districts. Mr. Bastian advises, "When contemplating opening a business in downtown Los Angeles, it's important to have capital for building out the store and a marketing budget. It's not enough just to open your doors. You actually have to go and market and create interest in whatever it is that you are selling." With many major projects in the pipeline, such as the recently announced Eli Broad Art Museum on Bunker Hill and the one billion dollar rebuild of the Wilshire Grand Hotel, the community remains poised for future investment and expansion. While Downtown has always been a legal, banking, and cultural hub, the residential population base continues to grow and evolve, creating new needs in the marketplace for core and supporting businesses. These signs of continued growth promise to keep Downtown on the forefront of urban economic renewal. |

| David Kean is a Beverly Hills-based Realtor, small business consultant, and Downtown resident since 2002. |

Source: Los Angeles Times, September 18, 2009

Source: Los Angeles Times Magazine, March 3, 2008

|

Source: Los Angeles Times

Source: Los Angeles Times

Source: Los Angeles Downtown News, July 2011

Upgraded for the Second Time in Four Years, the Mercantile Lofts Tries to Buck a Housing Trend

by Richard Guzman

Published: Friday, July 8, 2011 11:11 AM PDT

Inside the lobby at 620 S. Main St., soft purple stripes resembling bar codes line the walls and purple and white-striped curved benches that will be lit from beneath snake along the space. Hanging light orbs in the common areas add to the upgraded feel of the 1906, Chicago Beaux Arts-style building.

The most dramatic change, however, can be seen from the street. Construction crews are adding a glass façade to the ground level. That sits below the building's 35 units, which have floor-to-ceiling windows. Right now, passersby can peer into the empty homes.

Originally converted to apartments in 2007, the building is bucking a trend. In the past few years, it has been far more common for projects planned as condominiums to open instead as rentals.

"We feel that Downtown L.A. has become a mature market but that demand is not in line with the supply with so many units going rental," said Joseph Soleiman, director of acquisition and general counsel for ICO Group, which purchased the Mercantile out of foreclosure last year.

It's an effort that real estate players are watching. After all, before the economic downturn, some Downtown developers had discussed turning apartments buildings into condos, and giving renters in the structures first shot at having an ownership stake in the community.

Despite the still-soft housing market, experts believe that if the price is right, the buyers will come to the Mercantile.

"If you look at the market in L.A. right now, anything under $400,000 seems to be moving really quickly," said Richard Green, chair of the USC Lusk Center for Real Estate.

That could be a fit for the Mercantile, where residences are priced at $250,000 to $550,000. There is still no timeline, however, for when move-ins will begin.

Bargain Hunters

"There are absolutely a lot of interested people out there that are looking for bargains, and they're getting financing," said David Kean, a realtor with the John Aaroe Group. "It's like the old days, 20%-25% down, verifiable income and good credit."

According to figures provided by Kean, in the last six months there have been more than 200 condominium transactions in Downtown Los Angeles. Most have been re-sales, with the average unit going for about $300,000. That's far below the height of the market, when condos were commonly listed at $600,000 or more.

In the past few years, several Downtown buildings planned as condos instead went the rental route. They include the Amidi Real Estate Group's $50 million TenTen Wilshire in City West; the 118-unit Artisan on Second, developed by Trammell Crow Residential, in Little Tokyo; the Chapman Flats, a 13-story, $30 million adaptive reuse project at Broadway and Eighth Street; and The Great Republic Lofts, a 13-story, 72-unit project at 756 S. Spring St.

The ICO Group, headed by Alex Moradi, in 2005 opened the mammoth Pacific Electric Lofts, which is now 98% occupied. The company's portfolio includes 4 million square feet of commercial, retail and industrial properties in Southern California, Nevada and Missouri, and more than 700 apartments in Los Angeles and Denver.

ICO purchased the Mercantile, which is immediately south of the Pacific Electric Lofts, last year from Citibank, which had foreclosed on the property. Company officials said they are banking on less competition and bargain prices as they go the sale route.

"The only real other options are distress sales or secondary market sales of distressed units, so we felt this was an opportune time for us to bring affordably priced, very unique product to the market," Soleiman said.

Soleiman would not release figures on the renovation or what the company paid for the building. According to the County Assessor's office, the structure at 620 S. Main St. was sold in 2010 for $4 million.

The property in 2007 underwent an $8 million conversion by developer Oxford Street Properties. That turned the 75,060-square-foot, six-story structure into industrial-style lofts. It was nearly completely occupied when ICO took over. Tenants were given up to 60 days to move. Some were relocated to the Pacific Electric Lofts.

The open-space units range from 700 to 2,000 square feet. Each comes with a parking space, stainless steel appliances and a washer and dryer, and some have wall-to-wall windows. Buyers can access amenities at the Pacific Electric Lofts, which include access to a pool, a roof deck, dog run and media room, for $100 per month.

So far, no properties are in escrow, though Soleiman said five people have pre-qualified for financing. Still, he believes the demand is there, especially since the condos are priced about 35% below what they would have cost a few years back at the height of the market.

"We're being cautious," he said. "We need people to go through our pre-approval process. Our interest is not getting people into something they can't afford."

Watching, Waiting

Other Downtown developers think it's too early to tell if the Mercantile's switch marks a change in tactics, but they agree that if the price is right, condos will sell in Downtown.

"I think the Downtown condo market is at the bottom of where it's going to go," said David Gray, who has worked on several conversions of old Downtown buildings into residential space, including The Great Republic Lofts. "If they can be competitive, they're making the right move. It's a buyer's market right now."

Bill Stevenson of Downtown Properties agreed.

"If you price things at market, things will sell nicely," he said.

Stevenson speaks from experience. The developer's recent buildings, the Rowan, which opened in 2009, and the El Dorado, which came online last summer, were among some of the few projects built as condos that stayed the for-sale route.

Not that it has been easy. At the El Dorado, 51 of 65 residences have been purchased, although Stevenson originally expected to be sold out by the end of 2010. The Rowan needed a kick-start in the form of an auction that moved 63 units; today, 185 of the 206 condos have been purchased. Stevenson called it a pretty steady pace over two years.

"There's not much more being built," Stevenson said. "With the exception of re-sale, not a lot of new product is available. There's simply not a lot of competition."

That helps explain why some developers are still being cautious. One of them is Peklar Pilavjian of Alameda and Fourth, LLC, which is creating a $20 million project at Alameda and Fourth streets. Although initially planned as condos, Pilavjian said it will probably open as rentals because he is unlikely to get the prices he wants for the 53 artist-in-residence lofts in the former Beacon storage company building.

"If things pick up in the next few months, we'll go for-sale, but we'll have to wait and see what the market bears," he said.

That means he'll be watching the performance of the Mercantile Lofts. Soleiman knows his small project will be in the spotlight.

"They are probably going to be looking at us as the leader to tell them how successful we're going to be," he said. "We'll sell. We're pretty confident. We have the ability to be patient, and with that patience comes the right type of buyer."

Contact Richard Guzman at richard@downtownnews.com.

page 1, 07/04/2011

©Los Angeles Downtown News. Reprinting items retrieved from the archives are for personal use only. They may not be reproduced or retransmitted without permission of the Los Angeles Downtown News. If you would like to re-distribute anything from the Los Angeles Downtown News Archives, please call our permissions department at (213) 481-1448.

Source: San Francisco Chronicle

| Source: Los Angeles Downtown News, October 2008 | |||

Can't We All Get Along?

DOWNTOWN LOS ANGELES - It seems that nowadays many Down-towners think their neighborhood is the only good place to live in Downtown Los Angeles. Where has this attitude come from? Is it dividing us? As Downtown has evolved into a residential area, it has created several micro-neighborhoods. Each community has a distinct flavor and residential demographic mix.

On the flipside, some see it as too homogenized. "South Park is too sterile, too cold. It's not living up to the hype and a lot of residents are feeling a little sore over that. It should've grown organically." Some view the residents as more suburban-minded than urban. |

|

|

Source: The Miami Herald

| David Kean, with Estela Lopez, Executive Director, Central City East Association, and Jan Perry, Los Angeles City Councilmember, Ninth District - Source: Los Angeles Times |

|

These are just three of the approximately 10 long-planned rental buildings slated to open Downtown this year. But as the developers get set to debut their multi-million dollar apartment complexes, they are suddenly encountering more competition than many expected. The Downtown Los Angeles rental market has hit a storm that, if not perfect, is certainly jarring to many. Along with the expected slate of apartments, would-be renters now enjoy a wider choice from condominium developers suddenly fearful of being able to sell units for $400,000 or more during a credit crunch. Then comes a slew of other units created by a "shadow market," as investors who purchased condominiums several years ago strive mightily to rent them out. In short, supply seems to have finally caught up with demand in Downtown's rental market. The trend, say experts, is likely to continue. "Downtown two years ago was one of the tightest markets around," said Dolores Conway, director of USC's Casden Real Estate Economics Forecast. "You could find something to buy, but not to rent, because of the huge housing boom. Then the market changed. We have seen a steady decline in occupancy in 2007." The dip has been largely spurred by the subprime mortgage crisis, which has thrown the entire housing market into a tailspin. That, combined with the fact that Downtown rents have risen in recent years, has prompted some developers to turn their condominium efforts into rentals in the effort to keep the cash flowing. The speculation is that many will seek to ride out the storm and, when the market rebounds, convert the apartments to condos. Staying competitive amid the growing number of rental units poses a challenge to Downtown developers. Experts say those looking for apartments in the community will likely see rents flatten or even drop over the next year. "There's a lot of choice Downtown," said David Kean, a broker with Prudential California Realty who represents properties Downtown and on the Westside. "People are going to have to step up to the plate and offer more amenities, offer a month's free rent. I think there will be a glut - but there already is a glut." A Crowded Landscape Rents in the area encompassing Downtown and neighborhoods east to the 5 Freeway, west to Hoover Street and south to Washington Boulevard currently average approximately $2,068 for a two-bedroom apartment, or $2.08 per square foot, said Conway. The Downtown core has been on the higher end of the scale. The Related Cos.' Hikari apartment complex in Little Tokyo opened in late 2006 with many units going for more than $3 per square foot - or nearly $3,000 for a two-bedroom residence. At the recently opened Orsini II in City West, two-bedroom units start at $2,200. Soon, renters could find themselves with a lot more choice. Upcoming rental projects that were previously planned as condominiums include two buildings by SB Lofts developer Barry Shy with a total of more than 400 units, both expected to open within a year; the Amidi Real Estate Group's $50 million, adaptive reuse high-rise Ten Ten Wilshire in City West, opening next month and bringing 227 units available for short- or long-term lease; and the 118-unit Arts District building Artisan on Second from Trammell Crow Residential, scheduled to open by the end of this month. "The market always helps to dictate" whether a project will debut as rental or condominium units, said Michael Bustamante, a spokesman for Meruelo Maddux Properties, developer of the 92-unit rental building Union Lofts in the Jewelry District, to open imminently. "We built our project with flexibility in mind so we'd be able to adapt to market conditions, and that's what we've done." Between October 2006 and September 2007, 1,300 rental units came online in the Downtown area, said Conway. In approximately the same period, occupancy dropped from 97.8% to 96%. Although that does not sound like a steep fall, in rental terms the change is significant, Conway said. Previously one of L.A.'s tightest markets, Downtown now has a higher vacancy rate than Hollywood, the South Bay and the San Gabriel and San Fernando valleys. Condominiums put on the rental market by investors who bought hoping to resell the units in the near future for a hefty profit have further diluted the rental market. Condominiums available for lease last week on craigslist.com included units at the Packard Lofts near Staples Center, the Toy Factory Lofts in the Arts District, Market Lofts above Ralphs on Ninth Street, Elleven in South Park and the Eastern Columbia Building on Broadway. Including studio, one- and two-bedroom units, prices started as low as $1.60 per square foot and averaged just over $2 per square foot. Faced with a saturated rental market and the wild card of for-lease condominiums, some developers plan to lower prices in their upcoming projects. "We've anticipated this all along," said David Gray of 424 Broadway LLP. The developer and architect of the soon-to-open Judson building, as well as several other projects, added, "Everyone knew that there was a problem in the residential real estate market." "I think there's a tremendous demand Downtown," said Kim Paperin, a managing director at Trammell Crow Residential. Rents at the company's Artisan on Second start at $2,000 for a one-bedroom apartment. "I think we're all going to do well." Of the company's decision to shift from for-sale to rental units about a year ago, once construction had begun, she said, "The housing market certainly did have something to do with it, but we also saw a strong demand for rental housing." Owners of existing rental buildings also say that they have not felt pressure to drop prices. "Things are getting competitive, but between all my buildings I'm very satisfied," said Izek Shomof, who owns the Milano Lofts on Sixth Street and Grand Avenue, along with several buildings on Spring Street. Occupancy at his buildings ranges from about 97% to 100%, he said, and he has increased rents for some units in the past year. Conway predicts that while the growth of Downtown's rental market will continue at a similar pace through 2008, rents will likely stabilize. "Because we have a weaker economy, landlords will not have the strong demand that will allow them to raise the rents substantially," she said. At the same time, "the area's still very desirable to live in. Our best estimate is that rents will be close to what they are." One trend Conway expects to intensify in the next year is developers putting projects on hold as they wait to see how the housing market pans out. Yuval Bar-Zemer of Linear City, developer of the Toy Factory and Biscuit Company lofts in the Arts District, agreed. His next project, a condominium complex called the Mill Street Lofts, was expected to break ground early this year but has been delayed for at least nine months because of the current housing market. He has not considered converting the project to rentals, he said. "The cost of construction is so high, it's very hard to make the numbers work," said Bar-Zemer. "I think most of the projects that convert to rental have already broken ground; they can't stop the process and they decided to fill the time gap in the slow market." "Downtown is still vibrant," she said. "L.A. Live will be coming online soon; there's the Nokia Theatre, Disney Hall, the Cathedral. There is a large demographic trend of young professionals and some retired Baby Boomers. Long term, I actually think things are going to be fine. "But," she added, "it's hard to predict what's happening, because everything is in flux." |

The Realtor Buddies |